After Prince Philip is involved in a road accident, is it time for driving retest regulations to be introduced for the older generation?

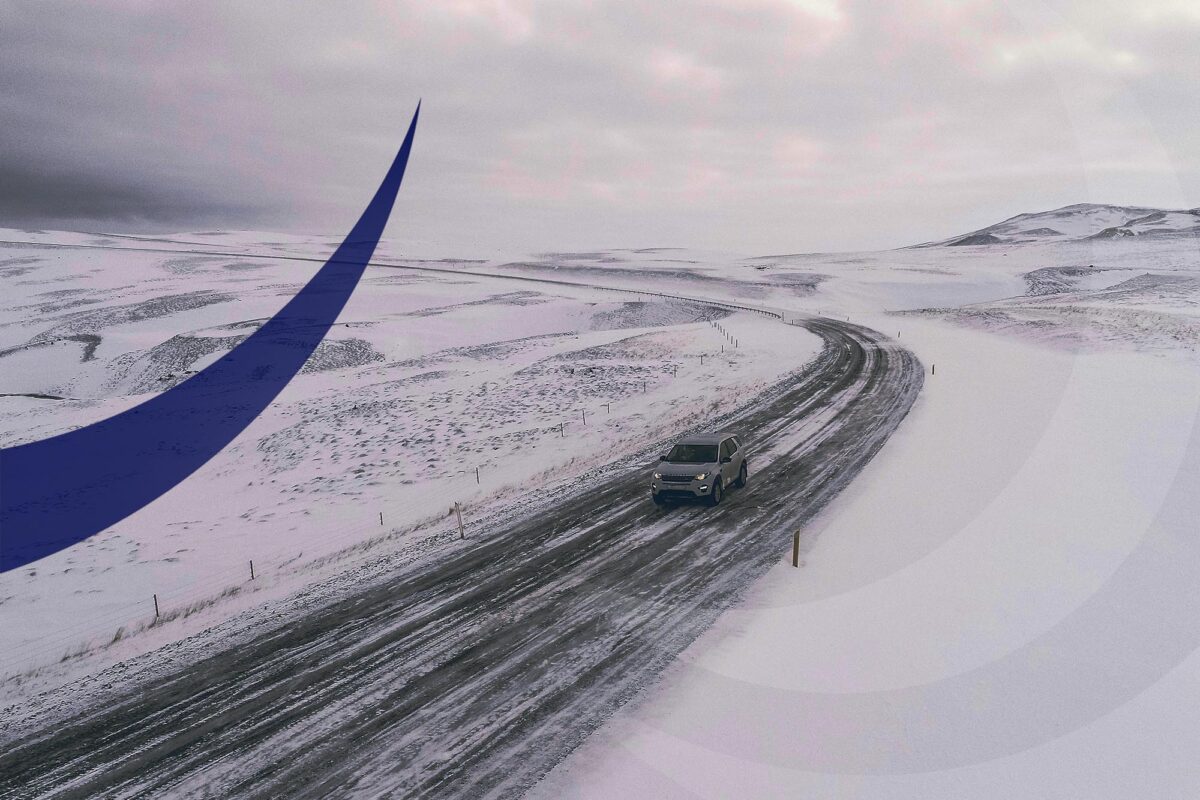

Images of the 97-year-old Duke of Edinburgh looking stunned behind the wheel of his Land Rover after he hit a Kia recently have shocked the nation. With many taking to social media to express shock and outrage that Prince Philip was still allowed to drive on public roads, despite being five months short of his 98th birthday, the debate over whether older drivers should be made to retake their test or even be banned from driving altogether has been thrust to the forefront once again.

Two industry experts, Mick Conway and Rob Davidson of Total Claims Solutions, who both have over 30 years of experience in the motor claims business, explain the case for retesting elderly drivers.

“Under the current law, drivers over 70 have to renew their license every 3 years, but there is no independent check which verifies whether they are still able to drive safely,” explains Mick, Director of Total Claims Solutions. “Drivers only have to self-certify that they are fit to drive.”

It is this that worries some, particularly in light of Prince Philip’s accident, where he hit a car containing a 9 month old child.

“Deteriorating eyesight in older people is one of the key issues.” Mick continues. “For every decade past 25, drivers need twice the amount of brightness to see properly, so driving in low light or at night becomes a great deal riskier.

“In addition, it takes older people significantly longer to recover from the ‘dazzling’ effect caused by bright light. While a 15 year old’s eyes will typically recover within 2 seconds, for a 65 year old this extends to 9 seconds, and only keeps increasing.”

While the Duke of Edinburgh escaped his scrape miraculously unharmed, older people generally have a much higher risk of being seriously injured or killed in road traffic accidents.

“As we get older, our bodies unfortunately become much more fragile,” says Rob, Total Claims Solutions’ Director.

“This means when older people have a motoring accident, it is far more likely to be serious than for someone of a younger age. It could be argued that enforcing the retaking of driving tests to take into account someone’s age is not about saying older people are poor drivers, but about ensuring that they understand the increased risk to themselves as well.”

“Obviously, if older drivers were required to retake their driving tests, the administration implications of this would be extensive,” adds Mick. “But let’s not forget that the UK has an ageing population. By 2025, it is estimated that the over-65s will account for around 25% of all drivers, so this is definitely a question that cannot be ignored.”

“Ultimately, it’s about making our roads safer for everybody.”