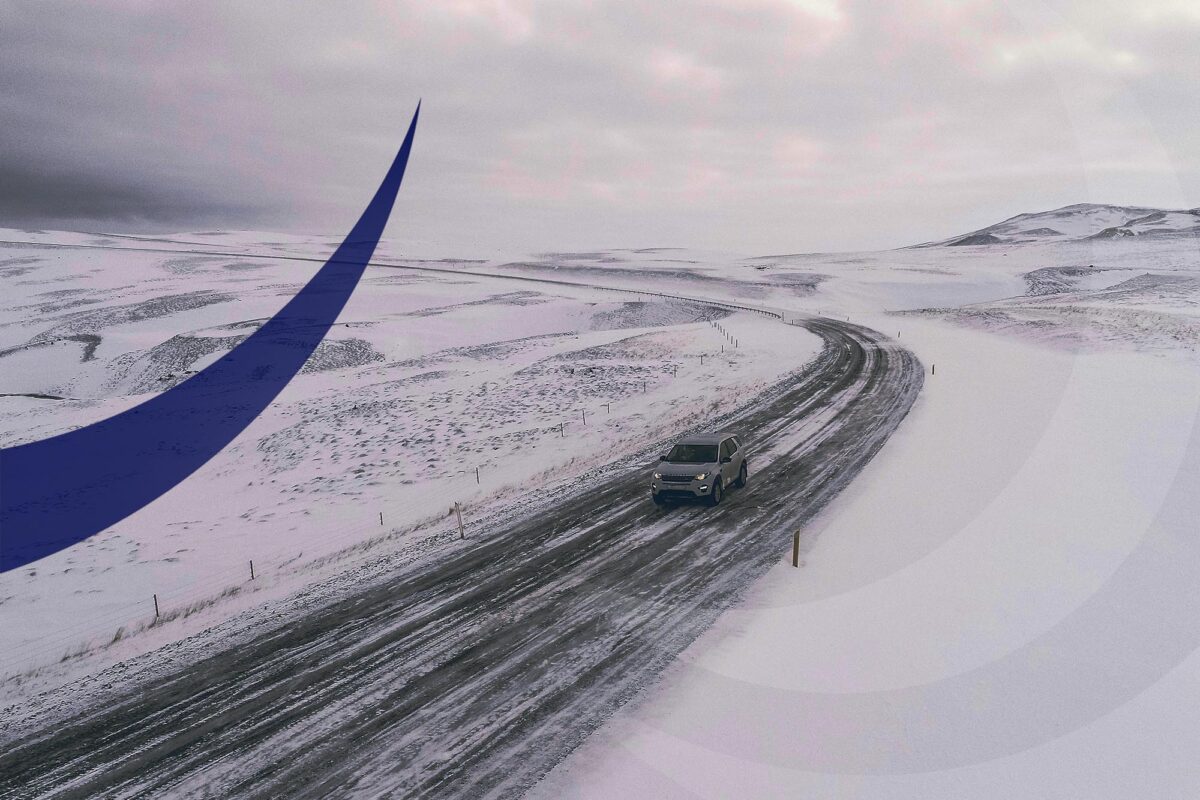

Make sure you’re ready for the cold snap with these handy tips.

December is upon us once more: the streets are decked with strings of lights; chocolate selection boxes line supermarket shelves and everything has a little bit more sparkle. As you’re enjoying the festivities though, be mindful that the temperature is dropping, and the roads are becoming more treacherous.

Motor claims specialists Total Claims Solutions have these tips to help keep you and your family safe on the road this December, and leave you free to enjoy all of the delights the festive period brings.

CHECK YOUR ANTIFREEZE BEFORE YOU DRIVE

“It sounds obvious, but a lot of people top up their anti-freeze once and then forget about it,” says Mick Conway, Director at Total Claims Solutions.

“Your car radiator should be a mix of 50% anti-freeze and 50% water, but this often becomes diluted over time. Make sure that the level is between the ‘min’ and ‘max’ indicators before setting off on any long journey to avoid freezing up this Winter.”

DEFROST YOUR WINDOWS FULLY BEFORE SETTING OFF

With sub-zero temperatures on the horizon, the time of the dreaded defrosting of the windscreen first thing in the morning is almost upon us. It can be a tempting to start driving before your windscreen and side windows are fully defrosted, but this can be incredibly risky.

“You should always de-ice your car fully and in a safe manner before setting off,” Mick says.

“It is also worth noting that if you leave your car unattended with the keys in the ignition, it can be an easy target for thieves, and your insurance may not pay out,” he adds. “It’s not worth leaving the car during defrosting, even if it’s just for a few minutes.”

SLOW DOWN!

As keen as you may be to get to see loved ones this festive period, with roads potentially icy it’s important to keep an eye on your speed.

“It takes a lot longer to stop your car on an icy surface,” Mick explains. “It’s recommended that you leave about three times the stopping distance than you would in perfect conditions.”

“In addition, ease up on the breaks and the accelerator whilst driving, decreasing and increasing your speed at a slower rate than you would normally,” he advises. “This minimises the risk of skidding out – one of the biggest causes of Winter accidents.”

CHECK THE LOCAL WEATHER BEFORE TRAVELLING

“Pay particular attention to any snow forecasted and ice and visibility warnings, and be sure to factor in changing conditions if you are travelling a considerable distance,” says Mick.

If you can avoid driving in these conditions, do. It’s not worth the risk of an accident for journeys that aren’t absolutely essential.

NEVER DRINK AND DRIVE

The festive period can be packed full of exciting social occasions, many of which may revolve around the pub. Drinking and driving must never be an option though, even if you feel sober.

“Even just one drink can create illegally high levels of alcohol in the blood. As soon as you’ve had a drink, your reactions slow down and you risk putting yourself and other road users in danger.”

“More police are watching the roads at this time of year as well, so your chances of getting stopped are even higher,” Mick adds.

“Work out alternative ways to get home from your night out before you buy a drink. It’s never worth the risk!”